Arcanum Ventures

Arcanum Ventures is a venture capital investment firm, blockchain advisory service, and digital asset educator. We bring precise knowledge and top-tier expertise in advising blockchain startups.

Arcanum demystifies the blockchain space for its partners by providing intelligent, poised, crystal clear, and authentic input powered by our passion to empower and champion our allies.

We unravel the mysteries and unlock the opportunities in blockchain, Web3, and other emerging innovations.

Web3 Fundraising: Tokens or Equity?

“Tokens or equity?”

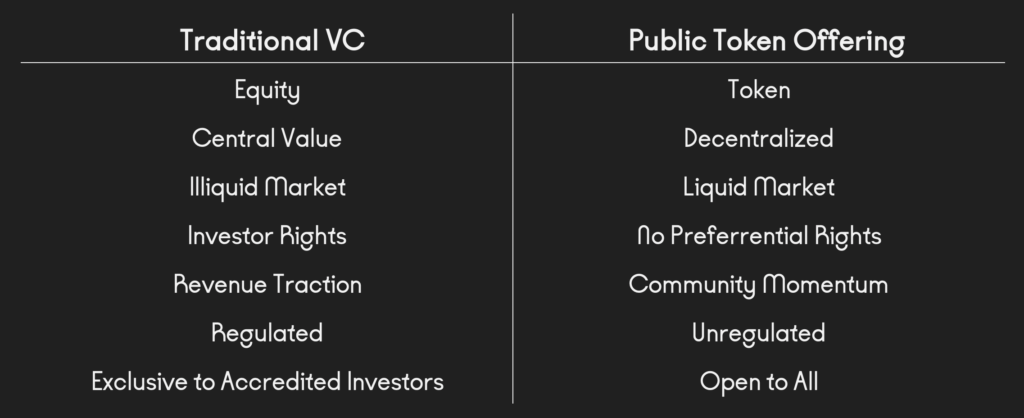

This seems to be the most common question founders ask when structuring their fundraising strategies. The industry has changed, investor interests have shifted, and founders are playing catch-up.

The simple answer is the one everyone fears – “it depends.”

In this article, Arcanum Ventures discusses how the real value driving a token is its “use case,” and how leveraging this asset for fundraising can pose massive risks. The article also explores the growing interest behind hybrid fundraising models, and how offering both corporate equity with token warrants or token side letters can insulate the ecosystem from aggressive investors.

Hierarchy of Token Utilities

At Arcanum Ventures, we classify token use cases in a simple hierarchy based on an easily understood priority – “How good is it?”

Although subjective, the classifications help us understand not only the investment viability of a token economy but also the potential for adoption by the target user. Here are the ways we break them down:

- Primary Utilities: The token is essential to the function of the product, platform, or protocol. Using a digital asset in the consensus mechanism of a Layer 1 blockchain network, for example, is a primary utility. Additionally, DAO-based governance can be considered a primary utility because it requires the distribution of a digital asset as a measurement of voting weight by stakeholders.

- Secondary Utilities: These use cases are non-essential to the function of the platform. Although the product or platform can exist and function without tokens, these use cases do add to the overall product quality or user experience. Cryptocurrency rewards based on skill and merit for a video game are a great example. This use-case allows players to be granted true ownership over something of tangible value, which gives the game a competitive edge over others that don’t integrate digital assets.

- Tertiary Utilities: This includes everything else, and although it may seem like a catch-all bucket of poor token design, there’s a reason for it. Tertiary utilities can be considered any use case that has no positive effect on the product or user experience and may have the opposite effect. Take the “native token payment barrier” for example, where users of an NFT marketplace must first purchase a fungible token to spend on an NFT they want to purchase. Not only does this use-case create an inconvenience for the user since this same function can be performed with any other cryptocurrency, but it also adds financial risk to the company’s operation. The company foregoes diversified revenue in the form of major cryptos and fiat currencies, in exchange for their own low-liquidity token they already own a majority supply of.

A Brief History of Token Sale Fundraising

There’s been a very noticeable shift happening over the last two years, from naivete to normalcy. Web3 investors have slowly come to understand their misinterpretation of token fundraising.

The unspoken assumption of tokens representing corporate ownership and being a reflection of company value died as stakeholders competed in a race to the bottom of the liquidity pool. Token supplies once valued in the billions of dollars sank to zero while startup companies continued to build, operate, and bring in revenues despite their failing digital asset value.

Figure 2: The Rise of the Token Sale by Max Mersch

As time went on, investors began to wisen and take a more traditional approach to venture capital. Opting for equity investments became the new norm in the industry. Still, they were reluctant to give up the promise of early liquidity – something rare in Silicon Valley.

The startup industry shifted to accommodate a growing appetite, and offering up both equity and tokens became a new standard.

The Problem With Early Liquidity

Understanding your investors is critical as a startup founder. You learn to predict their investment strategies and how they manage the assets you grant them. Unfortunately, the industry showed us the ugly side from the beginning, and many investors having claimed to be “in it for the long haul” would quickly dump every single token they received.

The nonverbal agreement around token launches turned everyday people into victims. The returns promised to founders would come from retail investors convinced to buy in on a different promise. These casual investors provided the exit liquidity for early financial backers to withdraw, leaving a wake of bag-holders, and sometimes a useless product.

This is the more critical point – subjecting token supplies to extreme volatility and heavy sell pressure worked to destabilize economies built to supplement product experiences. Many companies that integrated digital assets into games, access models, and governance protocols suddenly encountered falling demand and failing products.

Founders learned the hard way that leveraging a token economy as a primary fundraising tool simply would not work when their backers saw vesting terms as prescribed dumping schedules.

The New Token Economy

Token economists work to understand all stakeholders within the ecosystem, what drives them, and how they’re most likely to behave. Many believe that there’s simply no way to avoid a zero-sum game when you involve both pre-sale investors and product users in the same fungible asset.

At Arcanum Ventures, we know there is a way because we’ve done it before. We believe token economies should be designed to supplement a product and cater to the user experience. This means establishing a product-market fit from the beginning and creating a digital asset that will appreciate value through user demand for the product or service.

The token then becomes an ecosystem asset – and when offered with an equity fundraising strategy, can be used to provide an added incentive in filling early-stage equity rounds. Combined equity and token offerings allow investors the early liquidity they love while limiting their exposure, and limiting the negative impact their potential liquidations can have on the token economy.

Conclusion

Although the growing interest in web3 equity came from investor interests, it was accompanied by a healthy side-effect. The classic trope of “it’s a feature, not a bug” quickly became relevant as satisfying investor appetite suddenly allowed a more viable end-product:

- The focus on equity meant that investors had real “skin in the game” and ownership

- Investors still had their early liquidity from tokens

- Founders limited investor token exposure by supplementing with equity

- Tokens could better serve as ecosystem assets that focus on products and features

These hybrid fundraising models opened a door in the world of tokenomics where philosophies like Human-Centric Design and Agent-Based Modeling were previously heard in passing conversations. This meant token economists could begin their real work, focusing more on how digital assets can solve existing problems in products, services, and industries.

What’s Next?

In the follow-up article, Arcanum Ventures will discuss Web3 tokenomics timelines, and how the necessity for a digital asset supply may become irrelevant or risky to keep in play. We will also outline example milestones that can serve as flags to sunset your token supply. We’ll also provide some concepts on how founders may set up their fundraising strategy and contractually structure this agreement to give investors options that benefit all in the long term.

If you’re interested in this content or you need support in structuring your equity and token offering for your Web3 startup, reach out to Arcanum Ventures – an industry-leading token design firm.

Arcanum Ventures

Arcanum Ventures is a venture capital investment firm, blockchain advisory service, and digital asset educator. We bring precise knowledge and top-tier expertise in advising blockchain startups.

Arcanum demystifies the blockchain space for its partners by providing intelligent, poised, crystal clear, and authentic input powered by our passion to empower and champion our allies.

We unravel the mysteries and unlock the opportunities in blockchain, Web3, and other emerging innovations.

February 11, 2025

Governance has a bad reputation in web3. The presumed miracle drug for any weak token economy has been thrown…

InvestmentPartnershipsToken Economics

January 28, 2025

Spheron is developing and launching infrastructure to simplify the world of GPU and CPU resource provisioning…

October 8, 2024

It goes without saying that starting a new business in any industry is an exciting venture, but so too does…