Arcanum Ventures

Arcanum Ventures is a venture capital investment firm, blockchain advisory service, and digital asset educator. We bring precise knowledge and top-tier expertise in advising blockchain startups.

Arcanum demystifies the blockchain space for its partners by providing intelligent, poised, crystal clear, and authentic input powered by our passion to empower and champion our allies.

We unravel the mysteries and unlock the opportunities in blockchain, Web3, and other emerging innovations.

Tokenomics Design: Staking

From every cryptocurrency trader to yield farmer. From every YouTube influencer wannabe to institutional investor. Everyone in crypto knows about “staking.”

Most understand the general concept, yet many don’t understand the true purpose or the implications of this function. In this third iteration of the Token Utility article series, we dive into this core cryptocurrency use case. We hope to offer some insights to give you a greater understanding of staking, and what it means for you and every other holder.

Arcanum Ventures is releasing this article series to help educate both founders and investors to better evaluate token economies. We hope this information can help you make a better informed cryptocurrency investment decision, or build a better tokenomics design that focuses on sustainability and product alignment.

Be sure to check out the token utility articles Part 1 on Payment Barriers and Part 2 on Access Models if you’re diving fresh into this one.

What is Cryptocurrency Staking?

It’s simple. You have some assets, maybe in the form of a cryptocurrency token. You “lockup” these assets up. You get something in return.

Breaking down each of these three steps will help us begin to think objectively about how we can use this token utility to better effect.

1. Holding The Asset

Depending on the economic agent profile doing the holding, there may be different individual incentives.

- Institutional Investors following a clear exit strategy to maximize returns

- Retail Investors most often hoping for speculative gains

- Yield Farmers hoping that company fundamentals can prop up the token price until they liquidate their crypto rewards

- And finally (and most importantly), Product Users staking the token to gain access to something useful on the platform

2. Locking The Tokens

There are two primary methods of doing this – custodial solutions, and non-custodial solutions.

- Custodial meaning the asset holder “temporarily” transfers ownership to another party. This is typically done through holdings on Centralized Exchanges (CEXs) or depositing into a “staking” smart contract governed by transparent code.

- Non-custodial, meaning you never lose ownership of the asset. It remains in your possession, most often in a decentralized wallet like Metamask. These tokens, however, are “locked” through a wallet integration or unique token standard code, preventing you from transacting them.

3. Getting Something In Return

Regardless of the agent profile, the economic incentive remains the same, something of value must be given in exchange for the stakeholder not redeeming their value out of the locked asset. Some common examples include:

- “Rewards” in the form of the same cryptocurrency asset

- “Rewards” in a different asset like stablecoin, fiat, or gift cards

- Discount or access to a product, service, or exclusive community

- And more innovatively (thanks to one of our designs) – Collateralized account balances for payment withdrawals.

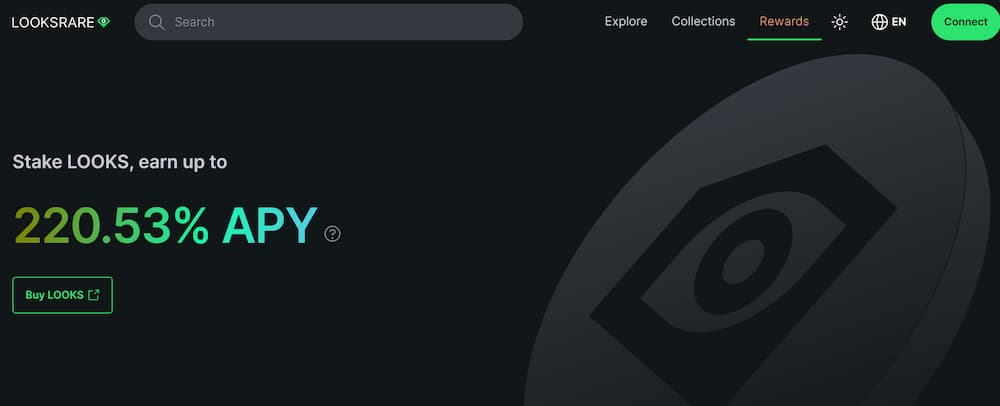

Figure 1: Gamerse provides a list of staking incentives catering solely to a financially-driven demographic

The Implications

There’s a very common theme here – a transaction of value is occurring. The demand driver for a staking utility is based entirely on the value of the something that is offered. This can be a measurable amount of cryptocurrency, like 25% APR in the same asset. This can be a free recurring subscription to a $25/month photo-editing platform. This can also be access to an exclusive Discord trading group where the holder can communicate with like-minded fellows.

In each case, there is some upfront and recurring capital that the company must incur for these offerings to take place. But if a stakeholder simply locks their assets to redeem them later, does this mean they are receiving value for free?

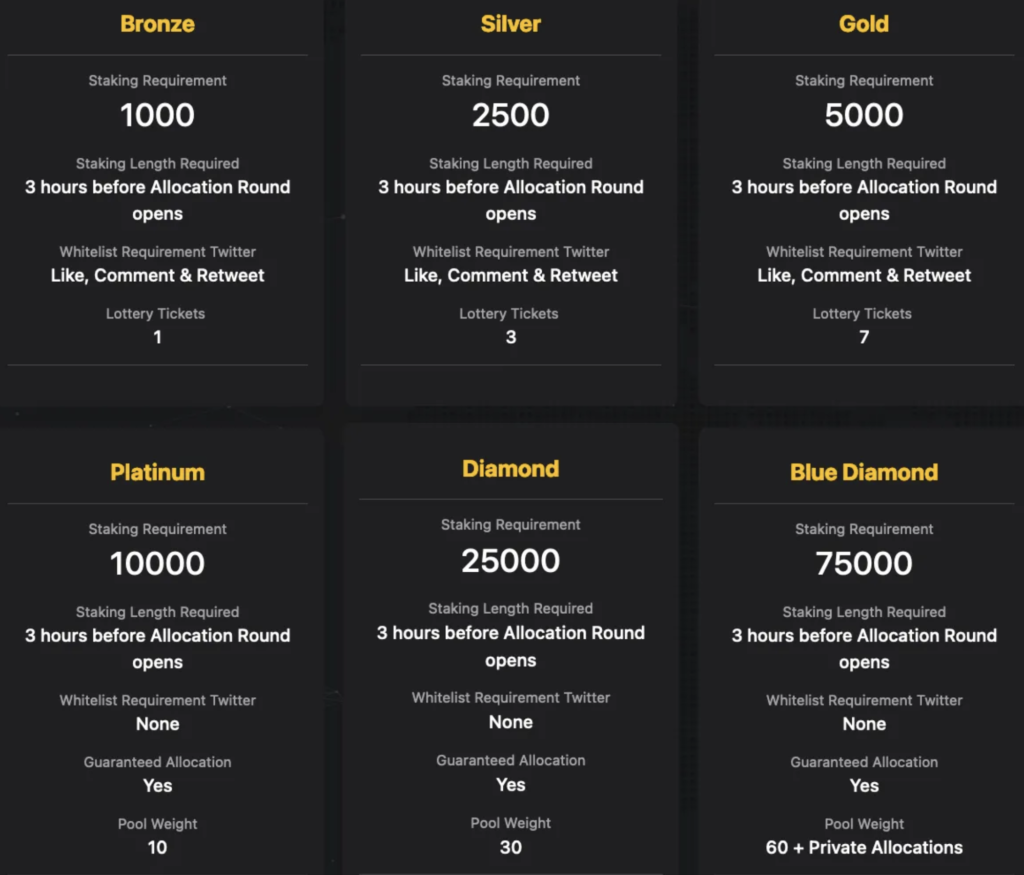

Figure 2: LOOKSRARE NFT Marketplace offers high-interest rewards to discourage selling after airdrop campaign

Not likely. Cryptocurrency startup companies typically hold a large portion of their own token supply. These tokens are considered semi-liquid assets since they are transactable but must be swapped to extract value in the form of a spendable currency like stablecoin or fiat in order to pay developers, for example. Therefore the company must compete for the same value every token holder has access to, across all DEX and CEX liquidity pools.

For some companies looking to leverage tokens on their balance sheet, staking is a method of removing players from the game. As a result, that retail investor or yield farmer who volunteers to lock up their tokens in return for more tokens must make a personal calculation:

“What are the chances of my locked tokens being devalued by competing liquidations, and supply inflation from rewards emissions?”

Figure 3: $LOOKS price history implies significant sell pressure regardless of incentives given to holders

Staking Can Be Risky

Staking is not a single-edged sword. It not only introduces risk for external token holders but creates instability for startup companies as well. In instances where staking is used as an access model, the company elects to forego traditional revenue generation and instead must prioritize corporate token liquidations to generate income.

Additionally, the risk extends beyond just finances as companies may need to dedicate time and resources to community management and public relations to manage expectations around a falling token price. Heavy liquidations may cause negative investor sentiment that can accelerate a token’s downward spiral.

On the chance the team integrated the token into use-cases around the product, like payment barriers or governance features, this volatility can affect the experience and may render the product useless.

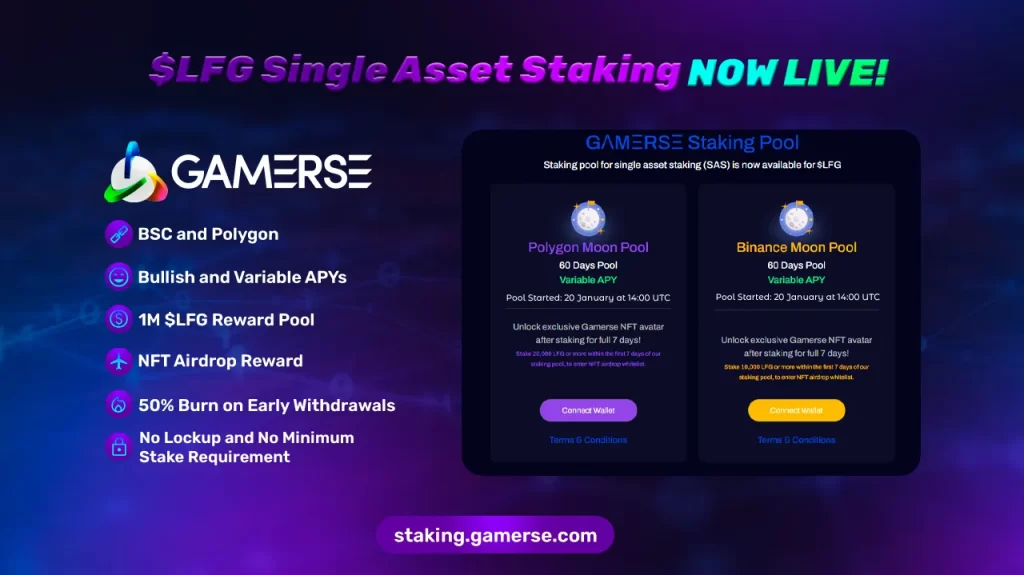

Figure 4: A launchpad’s staking model suffered from high price volatility and devaluing of their most exclusive tier by 95%

Let’s look at some real-world examples of how staking can either add to the experience or create massive liability.

Steelmanning the Argument: Staking Models That Work

A Web3 gaming studio is developing an exciting new title.

The company wants to integrate a fungible token into the design as an ecosystem asset. This token serves as proof-of-contribution, and demonstration-of-skills-and-knowledge, which allows player progression with in-game access models and payment barriers.

These tokens are deposited into a custodial staking contract by default and can be claimed by high-performing players to progress in the game or transact for other digital assets on marketplaces.

Tokens perpetually locked in these custodial smart contracts can inherently measure competency for each registered player. The game design incorporates aspects of governance in a micro-DAO where unclaimed, staked tokens serve as voting power.

This model can help address DAO concerns around open voting by an uneducated populace and also avoids the need to elect whale-like delegates that can commandeer a platform.

Breaking Down the Argument: Staking Models That Don’t

A new artificial intelligence startup wants to develop a decentralized finance (DeFi) platform that can help identify arbitrage and high-yield, liquidity provisioning opportunities. The company claims to prioritize decentralization and uses a native token access model. Users can stake tokens into a custodial smart contract that serves to register their wallet address as their account identification.

As a result of this “decentralized” design, they hope to raise all funds through a token offering to finish developing the product in eight months. AI is a hot topic and is quickly becoming a saturated market, so they offer additional value drivers for token investors such as “high APY staking rewards”.

This business model prevents the company from diversifying revenue, meaning they only generate income from their own volatile asset. In order to pay developers and marketers, the company must liquidate these tokens against their holders.

The added “token utility” of high staking APY will further devalue the token supply and their own balance sheet. It’s likely the token supply will hit rock bottom before the finished product launches once investors see tokens being transferred to CEX hot wallets and DEX smart contracts for liquidations.

Final Verdict on Staking Token Utilities

By now the risks around staking must be a bit clearer. The takeaways from these examples are as follows:

- Prioritize perceived value over tangible value for staking offerings. For example, access to a feature that the target demographic desires versus a currency giveaway.

- If using a native token access model or payment barrier, incorporate other ones to diversify company revenue but be sure to respect product-market-fit.

- Highly inflationary rewards are a poor incentive and a red flag for any company. As a founder, this will ensure the onboarding of users that are not aligned with your company goals. As an investor, this may imply the team will race you to the bottom of the liquidity pool.

No one should mistake the idea behind staking. There are no free meals. Value is always being exchanged and proprietors are likely structuring these mechanisms to gain more value in return – this is the definition of a profit.

The beauty behind creating sustainable staking utilities is properly aligning the incentives with the target stakeholders. This allows scalability and offering something with a high value arbitration between you and your audience – costs you a little, but to them it means a lot.

Keep up with future articles where we may pose some ideas on how staking can boost your product experience and offer solutions to significant problems in existing business models.

If this content interests you, be sure to follow Arcanum Ventures on our social media channels. If you have questions about your own token economics or your staking structure, we encourage you to reach out and speak with the Arcanum Ventures team to help structure your company’s digital asset economy.

Arcanum Ventures

Arcanum Ventures is a venture capital investment firm, blockchain advisory service, and digital asset educator. We bring precise knowledge and top-tier expertise in advising blockchain startups.

Arcanum demystifies the blockchain space for its partners by providing intelligent, poised, crystal clear, and authentic input powered by our passion to empower and champion our allies.

We unravel the mysteries and unlock the opportunities in blockchain, Web3, and other emerging innovations.

February 11, 2025

Governance has a bad reputation in web3. The presumed miracle drug for any weak token economy has been thrown…

InvestmentPartnershipsToken Economics

January 28, 2025

Spheron is developing and launching infrastructure to simplify the world of GPU and CPU resource provisioning…

October 8, 2024

It goes without saying that starting a new business in any industry is an exciting venture, but so too does…