Arcanum Ventures

Arcanum Ventures is a venture capital investment firm, blockchain advisory service, and digital asset educator. We bring precise knowledge and top-tier expertise in advising blockchain startups.

Arcanum demystifies the blockchain space for its partners by providing intelligent, poised, crystal clear, and authentic input powered by our passion to empower and champion our allies.

We unravel the mysteries and unlock the opportunities in blockchain, Web3, and other emerging innovations.

Tokenomics Design: Governance

Governance has a bad reputation in web3. The presumed miracle drug for any weak token economy has been thrown in the face of nearly every investor with little clarification.

“How could this farm-animal metaverse be managed by a DAO?”

There are times when governance makes sense, and then there’s every other time.

For this final iteration of the ‘Arcanum Ventures Tokenomics Design’ article series, we will explore cryptocurrency-based governance and DAO structures. In case you’ve missed the rest, be sure to read our previous articles on other token utilities, linked below:

- Part 1 on Payment Barriers

- Part 2 on Access Models

- Part 3 on Staking

- Part 4 on Burning

What’s the Deal With Governance?

Arcanum Ventures not only invests in technology and web3 startups, but we also build token economies. We understand more than most, how “governance” has been diluted in our industry

It’s become the butt of some bad joke, and for good reason. It’s technically a primary utility, requiring a token supply to implement. But, it’s a race car without an engine, in most cases, as teams fail to specify which decisions token holders will actually make.

Governance appears to have been used as a lazy use-case slapped onto startup pitch decks for “utility tokens” sold to investors. While these teams use these tokens to bootstrap their companies, they skirt securities laws by granting one or more of the following use cases:

- Offering something of value in exchange for the token: Similar to a loyalty or promotions program where the token grants you some product or service in return for spending it (Payment Barriers) – like a Starbucks gift card or a balance of airline points.

- Giving a slice of economic activity from the company and its products: Value accrues in the token as an “ecosystem asset” when others buy it on the open market to stake it to access something (Access Model).

- Assigning decision-making ability: People associated with the token, through some holding, earnings, or spending balance, are granted a voice in something.

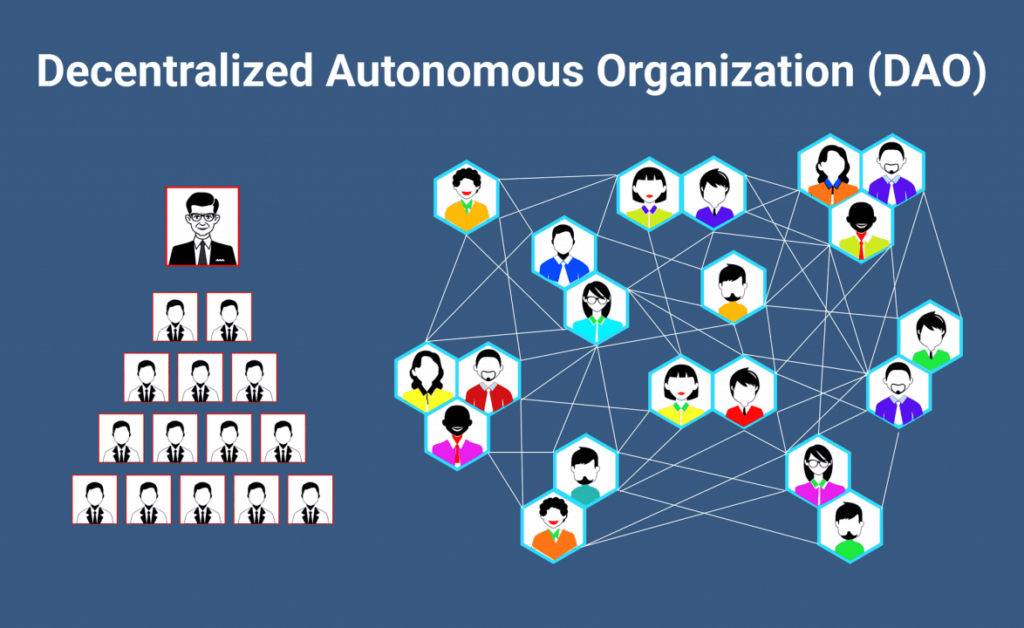

This last point references token-based governance, and it’s important because it can enable a protocol to do many things if used properly. Building brand loyalty by getting users involved in the product development process, is just one good example. This is the foundation of Decentralized Autonomous Organizations, or “DAOs” – communities of commonly-aligned individuals. Their input can help shape the future direction of the company.

Visual depiction of Decentralized Autonomous Organizations via News Coverage Agency

In a perfect world, governance can and should be used to give authority over:

- Use of funds from a common treasury grown through community-based crowdfunding

- Direction of changes or future development for a product

- Use and access to public goods, services, and infrastructure

It’s rarely used in this way, however, as most startups commit to very little decentralized control. As a result, many token-based governance systems grant as little decision-making ability to stakeholders as models of traditional finance systems.

Corporate Governance in Equities

Governance is no new concept. The idea of shareholder voting rights has existed since the early 19th century when the beginning of its evolution looked painfully similar to what we see in cryptocurrency governance today.

Annual General Meetings evolved from a more informal process of shareholders forums that consisted of family, relatives, and community members (token holders) who would discuss the conduct of a business and share collective wisdom with management (community engagement). These holders of common shares were often granted voting rights that allowed them to participate in a decision-making process (token-based voting).

The greater dispersal of corporate ownership, however, diverted from the demand for voting power, and preferred shares were offered as stocks without voting rights, granting the same monetary benefits of dividends (staking rewards). Different standards and regulatory frameworks were required for those who pursued a voice yet found it difficult to attend board meetings, and the process of proxy voting and delegating was incorporated into shareholder agreements (token foundation). These regulations also attempted to address management leaving absent voters in “dangerous ignorance,” and began to incorporate disclosure requirements and compliance measures to combat these abuses (limited governance).

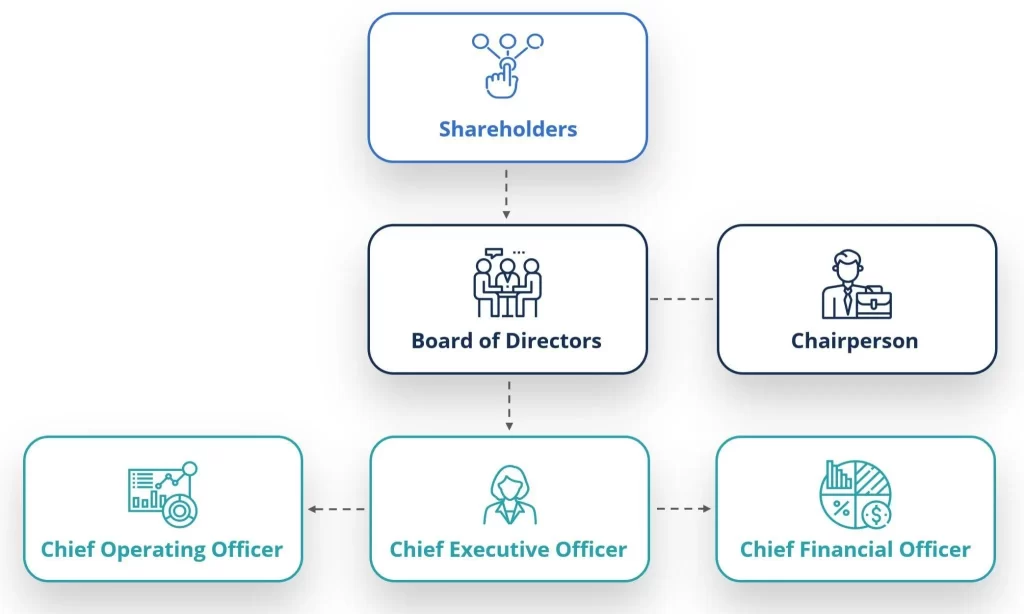

General flowchart of corporate governance structures courtesy of Governance At Work

General flowchart of corporate governance structures courtesy of Governance At Work

For many companies, corporate governance is quite simple. A Board of Directors passively oversees company operations managed by the Chief Executive Officer and other corporate executives. These board members ensure the company’s operations align with the interests of shareholders. These interests primarily consist of seeing a return on their investment, translated from price appreciation in their shares of equity. While shareholders appear to be “represented” in these centralized governance frameworks, they rarely have an active voice in decision-making. Additionally, shareholders are kept uninformed of day-to-day activities, receiving info through periodic reports outlining high-level direction.

The Cryptocurrency Version

Decentralized ledger technology now offers a greater degree of transparency around corporate governance while cryptocurrencies play a role in growing community engagement. Below are common use cases for decentralized decision-making along with notable examples.

|

GOVERNANCE USE CASE |

PURPOSE |

EXAMPLE |

| Protocol Upgrades | Decide on software upgrades, new features, and security improvements. | Ethereum transitions to PoS |

| Treasury Allocation | Manage DAO treasury, fund ecosystem development, and prevent fund mismanagement. | Uniswap funding protocol growth |

| Economic Policies | Adjust validator incentives, trading fees, and tokenomics policies. | Aave liquidity mining incentives |

| Dispute Resolution | Establish decentralized arbitration, security patches, and emergency response. | Ethereum hard fork |

| Community Rules | Elect governance representatives, change participation rules, and decide other external aspects. | Polkadot rebranding initiative |

| Mergers, Acquisitions, & Partnerships | Approve partnerships, mergers, acquisitions, and protocol integrations. | Lido to new blockchains |

The Risks Behind Decentralized Governance

Make no mistake – cryptocurrency-based governance offers some very real benefits over existing processes in traditional finance. For example, extreme transparency is ensured through on-chain data, while anyone with a computer and internet connection can police company operations. The progression of smart contract technologies means constant innovation with new infrastructure. Even regulators are catching up with DAO legislation to promote the operation of decentralized governance.

This technology in its current state still has serious drawbacks that must be considered when structuring DAO-based governance for your business.

Security and Corruption: Hacks are still commonplace in the industry, as bespoke smart contract development poses challenges for auditing. From a governance perspective, a vulnerability can mean a complete collapse, as the possession of governing assets can be consolidated under the umbrella of a proven bad actor. While this seems like a minor problem to roll back, many DAOs lack the infrastructure to do so. Even fewer have the processes to reimplement votes on proposals that were swayed by misinformation campaigns, for example. While these systems are in the “beta testing phase” as patches arise through problems, these organizations can lose millions of dollars.

Imbalanced Voting Rights: “One token, one vote” … this is the original idea for governance and still the most widely used. The problem is, unlike fungible tokens, not all votes are created equal. And many tokens are often issued to pre-sale investors that happen to be in the right place at the right time. This grants too much voting power to potential uninformed investors whose greatest incentive is to leverage a company’s name and marketing content for the largest speculative return on investment possible. These investors can sway governance decisions to create conflicts of interest and line their own pockets while destroying a company in the process.

A Bubblemaps Case Study titled “The Illusion of Democracy” showcases Uniswap token supply centralization

Efficiency and Execution: There exists no standard and efficient framework for introducing proposals and executing resolutions. Many cryptocurrency governance models and DAOs are still new. They are constantly testing theories and learning lessons between the milestones of “idea” through “execution.” While governance models grant a voice to everyone involved, they rarely hold these voices accountable when it comes to actually doing the work and making the change.

Community Misalignment: Like everything else in the world of web3 and cryptocurrency, marketing plays a pivotal role in the outcome. A technology startup that creates content catering to a demographic of uninformed, speculative investors will end up with uninformed, speculative token holders. This demographic is the widest globally and consists of people from all different countries, backgrounds, and cultural norms. Bringing this community into a decentralized governance model can prove problematic due to a lack of common vision. For example, a community of token holders that decentrally governs a treasury focused on providing grants to animal shelters – a single goal that’s easy to achieve. Whereas, a community of speculative traders who govern a treasury of funds will all have vocal members with different ideas that can lead to many poor decisions and bad ventures.

ApeCoin’s DAO governing a treasury of over $200 million in $APE tokens voted to launch a line of canned water

If challenges within voting processes and execution can be addressed, then governance can work quite well. Let’s look at two hypothetical scenarios around good and bad models.

Steelmanning the Argument: Governance Models That Work

A decentralized edge-computing network provides affordable and scalable GPU and CPU computational resources. Its customer base is diverse, ranging from large enterprise organizations like academic research institutions to independent developers using AI-powered LLM wrappers.

The protocol wishes to decentralize governance around specific aspects of the company within the next two years. Relinquishing control of these aspects such as pricing structure and future product development are high risk for the company. The system could break if the governance protocol does not grant decision-making authority to the right actors – a competitor could tank the company if they acquire too much voting power, for example.

The company decided to implement a multi-faceted voting system that factors in different metrics like financial investment, contribution, reputation, and stakeholder classification.

They separate Voting Rights from Voting Power, to create more accountability. After all, there is no logical reason for any supplier or consumer to have multiple accounts on the platform, and doing so would only be an act of malice.

Voting Rights are therefore granted by acquiring a decentralized identifier any user needs to operate on the network – Done!

Weighted Voting Power is even more complicated. The foundation wants to grant greater weight to contributors, so they can give greater decision-making to individuals or organizations that use the platform the most – ensuring future product development is catered directly towards their needs.

The foundation uses the following metrics to measure voting power and attributes different weights to each:

- Token Holdings: Serving as Proof-of-Investment, as individuals who buy tokens should have some voice in the protocol.

- Token Rewards: Any individual or organization contributing through marketing campaigns, referral programs, etc., earns measuring Proof-of-Contribution, which can be greater than simple holdings.

- Consumer Spending: Consumers who spend fiat or cryptocurrency on the platform have a growing history of platform activity. They understand their own needs and how the product should evolve to suit them in the long term.

- Supplier Earnings: Suppliers who provision computational resources also understand the areas for improvement from their own perspective. Their historical earnings can factor into their voting power, allowing them to make decisions on product development to better suit their own needs.

- Supplier Reputation: Suppliers who consistently and reliably provision resources should get an added voice since they demonstrate greater contribution.

Each of these metrics may hold different weights for different stakeholders. Together, they make up the voting power system, which can evolve as the Foundation monitors governance proposals and outcomes. The outcome is a more efficient and fair governance system that ensures the company can both sustain and grow through community input.

Breaking Down the Argument: Governance Models That Break

A decentralized finance protocol has built a strong community over the past year by launching an NFT collection early into the hype cycle. The company recently launched a fungible $TOKEN backed by its large treasury accumulated through the NFT hype. The token was distributed disproportionately to NFT holders, pre-sale investors, and “VCs” who accepted early, favorable vesting terms.

The company hopes to decentralize governance around the allocation of its treasury funds, letting the community of token holders decide how money can be spent to improve the protocol, company, and community. They implement a “one-token, one-vote” governance mechanism to do so. This grants voting power disproportionately to early speculators who learned about the initial NFT drop from “100x investment communities,” and VCs whose portfolios showcase poor investment performance.

Today, the community consists largely of speculative cryptocurrency enthusiasts from all walks of life. The most ardent supporters are the most vocal individuals across their Telegram and Discord communities – anonymous photographs serving as faces of poorly structured sentences and inappropriate dialogue. Governance proposals are sporadic and random such as allocating funds to “launch a memecoin that will go to the moon” or “selling a line of energy drinks.”

The once $100 million treasury slowly dwindles to pennies over two years as the community lacks any aligned vision, fails to elect qualified delegates, and misappropriates funds into campaigns that yield little to no returns.

The token price continues to fall as supply is liquidated to fund these dead-end ventures, and the community eventually dies as members claim the project is a rugpull and the “devs dumped all their tokens.”

The Verdict on Governance

Decentralized governance is here to stay. While global connectivity improves, and citizens across borders interact with each other on a more frequent basis, DAOs will continue to thrive. Community members with shared interests will embark on joint ventures, and governance powered by cryptocurrencies offers the easiest, most transparent medium to make decisions together.

Cryptocurrency-based governance is still in its infancy and will continue to improve as we continue to break things. There are many considerations concerning the delegation of authority to your community of investors, product users, or followers, some of which can pose massive risks to your business. If structured properly, your DAO can grow and succeed in the right way.

If this content interests you, be sure to follow Arcanum Ventures on our social media channels. If you have questions about your DAO or governance model and how to prepare your technology startup for success, reach out and speak with the Arcanum Ventures team.

Arcanum Ventures

Arcanum Ventures is a venture capital investment firm, blockchain advisory service, and digital asset educator. We bring precise knowledge and top-tier expertise in advising blockchain startups.

Arcanum demystifies the blockchain space for its partners by providing intelligent, poised, crystal clear, and authentic input powered by our passion to empower and champion our allies.

We unravel the mysteries and unlock the opportunities in blockchain, Web3, and other emerging innovations.

InvestmentPartnershipsToken Economics

January 28, 2025

Spheron is developing and launching infrastructure to simplify the world of GPU and CPU resource provisioning…

October 8, 2024

It goes without saying that starting a new business in any industry is an exciting venture, but so too does…

InvestmentPartnershipsToken Economics

September 24, 2024

The future is virtual. While fax, email, and traditional news media see record-low impressions across the…