Arcanum Ventures

Arcanum Ventures is a venture capital investment firm, blockchain advisory service, and digital asset educator. We bring precise knowledge and top-tier expertise in advising blockchain startups.

Arcanum demystifies the blockchain space for its partners by providing intelligent, poised, crystal clear, and authentic input powered by our passion to empower and champion our allies.

We unravel the mysteries and unlock the opportunities in blockchain, Web3, and other emerging innovations.

Tokenomics Design: Burning

It seems unnatural – feeling delighted over destruction, excitement about a fire. The cryptocurrency industry may be the only bubble where “burning” is considered a good thing. In this fourth part of the Arcanum Ventures Tokenomics Design series, we’ll explore this heated topic.

If you’re just arriving to this series, be sure to check out our previous token utility articles below:

- Part 1 on Payment Barriers

- Part 2 on Access Models

- Part 3 on Staking

The Definition of Token Burning

Burning refers to the removal of a cryptocurrency from circulation.

Ethereum-based token startups that burn tokens will send portions of their supply to the universal “Burn Wallet” to manufacture this scarcity. This string of 0x000000s…, currently holding over $150 million worth of assets, is seen as the Black Hole of the crypto world. It’s impossible to reclaim any currencies from this address.

The Perception

Burning is often compared to a non-discriminatory dividend. As tokens are removed from circulation, more value is reassigned to all remaining stakeholders according to the demand-driven market capitalization. For example, if 100 $TOKENS exist with a Market Cap of $100, each token is worth $1. If half of the tokens are suddenly burned and the asset value and demand remain the same, then each token is suddenly worth $2.

The idea is, that burning provides this positive gain for all remaining stakeholders, but unlike dividends, this value is not distributed directly to token holders. There are no traceable transactions that monitor how this value is distributed. Here is where perception fights reality.

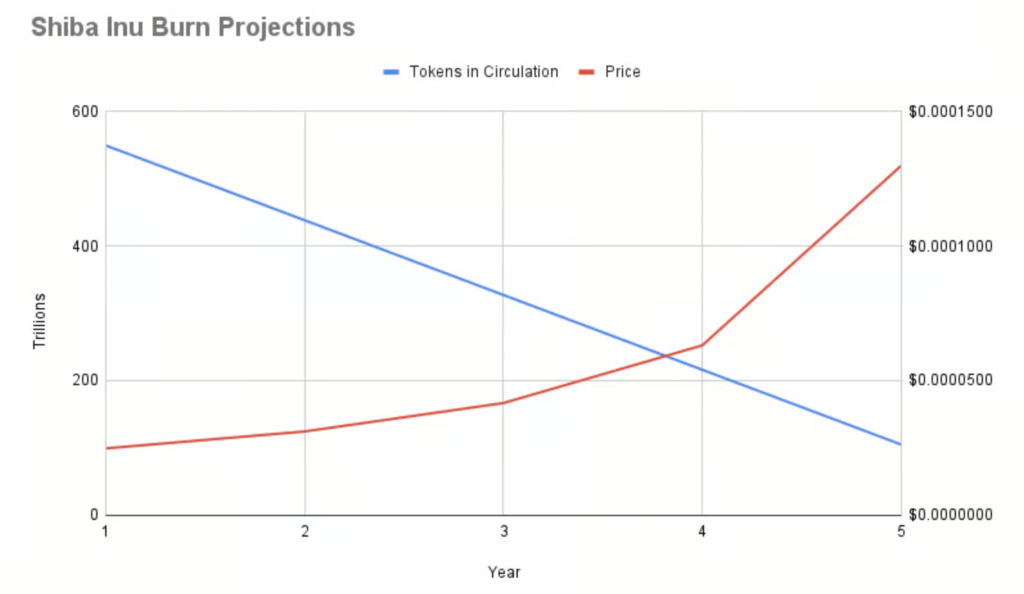

Figure 1: Simple chart by Motley Fool showing Shiba Inu deflation in comparison to anticipated coin price

The Reality

The simple example above implies that burning should directly increase a holder’s token price. But how is this change governed and reflected in the markets?

Token burning creates scarcity which can lead to price appreciation if the demand (or market-determined value) remains constant or increases. How is this scarcity programmed into smart contracts and markets – how do exchanges know how to price the remaining tokens once some have been burned?

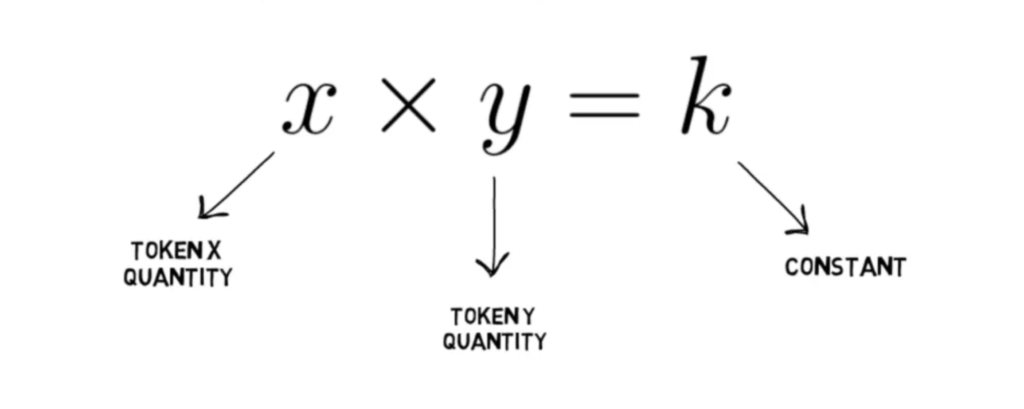

The Uniswap Decentralized Exchange model and the Automated Market Maker (DEX AMM) equation can give us some insight. The famous XYK below is simple enough to understand how token transactions can impact token price.

There’s no constant for total supply. There’s no variable for circulating supply. There’s no factor that measures tokens sent to the “Null: 0x000” Black Hole.

The Impact

The main factor seems to be Liquidity. The quantity of tokens available on each side of the trading pair governs price and volatility. Although CEX models may follow an order-book model, the arbitrage between the DEX anchor and CEX volume eventually closes, and the price falls back on an automated equation balancing supply and demand.

It’s safe to say that token burning does not guarantee token price appreciation. What it does offer is the following:

- Reduction of circulating token supply

- Eliminating tokens that are available to be sold on exchanges

- Creating speculation around the scarcity of the supply, and thus demand

Token Burning Legality

In many circles, burning is being compared to existing infrastructure that governs equity share issuance. There’s one major point of concern – all of these mechanisms are highly regulated to prevent market manipulation. These regulations work to combat speculation around supply reductions that can offer insider trading opportunities – the exact goal of many burning events in cryptocurrency.

To avoid future troubles, many reputable economists refuse to touch token burning. Others include a degree of flexibility that allows the product and company to survive, should regulations force the team to sunset their burning streak.

Anticipating Compliant Structures

Paralleling TradFi may offer additional peace of mind if regulators take inspiration from existing structures. Here are some concepts that Arcanum Ventures has used in previous designs, ensuring compliance in jurisdictions of corporate registration.

1. Stock Buybacks (a.k.a. Token Buybacks)

Stock buybacks are legal in many jurisdictions, while companies must adhere to specific regulations and disclosure requirements. Accurate recordkeeping of corporate transactions is a starting point. Hard coding these functions in smart contracts that reallocate revenues to buybacks will help buffer token price volatility around speculation, and reduce instances of market manipulation.

2. Treasury Stock (a.k.a Token Lockups)

Companies might hold bought-back shares as treasury stock. This reduces the number of outstanding shares (circulating supply) but allows these shares to be reissued in the future when needed. Smart contract infrastructure can implement token buybacks and long-term lockups to be released five years later, for example. Off-chain data oracle feeds can also be considered to trigger token releases should specific financial or business growth milestones be met.

3. Share Cancellation or Capital Reduction (a.k.a. DAO-Governed Burns)

This TradFi mechanism is uncommon and typically reserved for specific classes of stocks that must be made obsolete. The action involves shareholder consensus, regulatory approval, and specialized documentation. The process may include reclassifying the stock, implementing a buyback, and “gifting” back to the company – rendering the shares valueless.

Regarding Web3, consensus-based token burning can insulate cryptocurrency startups from regulatory scrutiny. DAO-governed actions can better comply with current regulations, even when members elect to reduce the outstanding token supply. Some global jurisdictions are fast-tracking DAO legislation to legitimize the corporate structure and allow innovation in this field.

Steelmanning the Argument: Burning Models That Work

A decentralized service provider is transitioning part of their core business to a DAO so they can allow clients to own and help operate a part of the protocol. This move coincides with early industry standards emerging around a compliance program to list currencies on a global, major centralized exchange.

Treasury tokens are offered to B2B clients as an onboarding incentive and to create a greater degree of DAO decentralization. The team transitioned to smart contract infrastructure that automates revenue redistribution to a token buyback and long-term lockup. The metrics governing these functions are controlled through the DAO governance platform, where participants can propose and vote on the following:

- Percentage of revenue reallocation

- Buyback and lockup duration

- Business growth triggers that allow early releases through external oracle feeds

The business will continue to generate revenue, grow under partial DAO control, and likely stay compliant through a higher level of automation and decentralization.

Breaking Down the Argument: Burning Models That Don’t Work

The undisclosed team behind the hottest new meme coin claims they will immediately burn half of the supply once they hit one million Twitter followers. All tokens are held in an unmarketed, unlocked wallet, minus whatever was loaded into the initial Uniswap LP.

Early on-chain transaction data shows one hundred similarly sized purchases of the token immediately after adding liquidity. A closer look shows the majority of these wallets have no previous transaction history and were all funded by the same Centralized Exchange hot wallet address, implying insider trading.

The team hits one million Twitter followers and pushes the token burn by a week to space in two big announcements, drawing attention to the event. The burn is implemented, volume spikes through increased speculation, and the blockchain tracks significant capital coming into these unmarked wallets through seemingly coordinated liquidation campaigns.

The potential market manipulation, insider trading, and lack of transparency correlating with centralized token control will likely bring regulatory scrutiny upon this token startup.

Final Verdict on Token Burning

Burning is hot, not only in the market but also amongst regulators. It’s a utility with a proven history among market manipulators and insider traders. Although it introduces much controversy, it’s extremely powerful and offers something that the traditional finance industry has failed to provide – incentive-focused value accrual for all stakeholders and participants.

Mimicking the effect of token burning with smart contract infrastructure, long-term lockups, and decentralization may help a startup stay compliant. The most critical consideration is, incorporating some degree of flexibility should your company be barred from burning tokens in the future.

If this content interests you, be sure to follow Arcanum Ventures on our social media channels.

If you have questions about your own token economics and how to effectively structure your burning utilities, we encourage you to reach out and speak with the Arcanum Ventures team for advice on structuring your company’s digital asset economy.

Disclaimer: It’s important to note, that Arcanum Ventures does not offer professional legal advice. Although the firm can provide insight based on the current state of industry regulations and developments, it’s recommended to consult with cryptocurrency legal professionals about local legislation relevant to your company’s business structure.

Arcanum Ventures

Arcanum Ventures is a venture capital investment firm, blockchain advisory service, and digital asset educator. We bring precise knowledge and top-tier expertise in advising blockchain startups.

Arcanum demystifies the blockchain space for its partners by providing intelligent, poised, crystal clear, and authentic input powered by our passion to empower and champion our allies.

We unravel the mysteries and unlock the opportunities in blockchain, Web3, and other emerging innovations.

February 11, 2025

Governance has a bad reputation in web3. The presumed miracle drug for any weak token economy has been thrown…

InvestmentPartnershipsToken Economics

January 28, 2025

Spheron is developing and launching infrastructure to simplify the world of GPU and CPU resource provisioning…

October 8, 2024

It goes without saying that starting a new business in any industry is an exciting venture, but so too does…