Arcanum Ventures

Arcanum Ventures is a venture capital investment firm, blockchain advisory service, and digital asset educator. We bring precise knowledge and top-tier expertise in advising blockchain startups.

Arcanum demystifies the blockchain space for its partners by providing intelligent, poised, crystal clear, and authentic input powered by our passion to empower and champion our allies.

We unravel the mysteries and unlock the opportunities in blockchain, Web3, and other emerging innovations.

Tokenomics For Reputation Systems

Utility tokens, securities, ecosystem assets… The cryptocurrency industry is in love with jargon, but what do they mean? Depending on the jurisdiction, the token economist, or the casual investor, you may get different definitions.

At Arcanum Ventures, we consider there to be a lot of room for overlap between these concepts from a legal perspective. From a business perspective, however, there’s a clear distinction.

A cryptocurrency designed as an “ecosystem asset” has one clear goal: to facilitate activity in the ecosystem while providing an improved user experience or solving traditional problems in parallel products.

What Can An Ecosystem Asset Do?

A fungible token supply used as an “ecosystem asset” can do many things. One of the most critical aspects that seems to be underutilized is a robust accountability system made possible by decentralized token supplies.

A token designed to serve as a reward system is effective because it grants some incentive with an asset that holds some monetary and extractable value. This means there’s real money on the table.

Figure 1: BigTime tokenomics are focused solely on onboarding players through rewards as an ecosystem asset

Many web3 users have demonstrated over the past few years that there is a willingness to invest time and effort in exchange for these types of rewards. This is such a commonplace idea that several buzzwords emerged to describe it. Farming or “___-to-Earn” quickly comes to mind.

The problem with rewards-based economies is sustainability, which is constantly challenged by the likelihood of user reinvestment. For sustainability to be achieved, value must be retained in the ecosystem.

Figure 2: Sustained token price for BigTime despite concerns about sell-pressure by emissions-heavy tokenomics

For every token reward that goes out to a user or player or stakeholder, the company must do its best to encourage this user to reinvest this reward in exchange for something else of value in the ecosystem.

Proof-of-Contribution

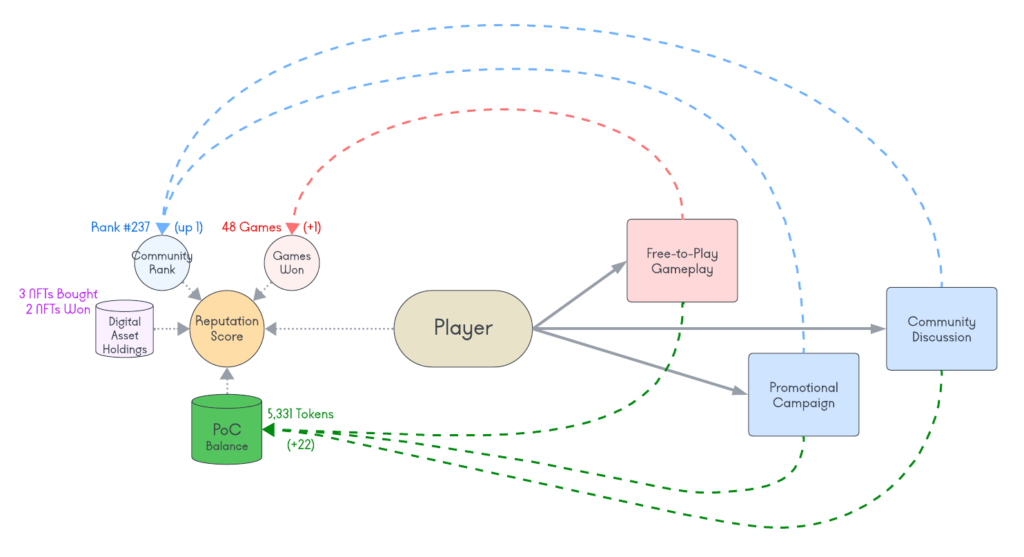

Enter “Proof-of-Contribution (PoC),” a concept we embrace at Arcanum Ventures. For token economies that distribute rewards based on strict criteria, only the very best participants will be rewarded. Structures like this enable a company to create some monetary incentive for users to answer genuinely in a poll, win competitive events in a game, or encourage healthy discussion in a community.

Depending on the mechanisms and the criteria put in place to determine reward triggers and amounts, the company can effectively utilize crowdsourced labor and effort from its user base.

A user’s earnings can therefore serve as a measure of these efforts. This is what we mean by Proof-of-Contribution.

How Can We Create Proof-of-Contribution Systems?

This is technically made possible through a certain degree of centralization, which many Web3 companies must maintain to ensure ongoing development and better-informed business decisions. For example, for a platform or protocol catering to a non-web3, general audience, like a freelancer talent marketplace, the company must require user registration to better manage profiles and ensure a degree of accountability.

These profiles can be created in parallel with a “custodial wallet” or “backend balance” that tracks the PoC earnings of an individual’s profile on the platform’s backend.

This custodial balance essentially serves as a one-way staking contract, where users can maintain their balance to serve as a PoC measurement. Alternatively, users can elect to withdraw their balance and exit the ecosystem once and for all – claiming their rewards and selling them on the open market to take a small gain for their efforts.

Monetary backing behind Proof-of-Contribution means there is some measurable value that a user can easily understand and weigh against the cost of malicious interactions they may partake in.

This easy correlation allows several functionalities:

Reputation Score Is The Low-Hanging Fruit

The PoC balance is a direct measurement of a user’s contributions to the ecosystem, indicating how “bought-in” or invested in the ecosystem’s health they may be. Although the balance may be small where reward emissions are limited, the one-way flow of tokens into these accounts means they can still be used as a comparative measure of contribution between different individuals.

The balance can be one of an aggregate of factors that calculate an individual’s reputation in the ecosystem. Other factors may include, the number of successful interaction events on a marketplace, community reputation from an ambassador program, and collateral, which takes us to our next point.

Figure 3: Proof-of-Contribution as part of a reputation score aggregate that’s influenced by player activity in a game

Collateral Is The Key To Accountability

The Proof-of-Contribution balance is perfect for collateralization. The monetary value behind tokens held in this balance means there’s real money to lose if an individual is considering a malicious action in the ecosystem. For example, a freelancer in a decentralized talent marketplace may accrue a healthy reputation score by completing eight different jobs, only to leverage their reputation to walk away with a big check and under-deliver on the next big job. The primary concern in this example is the potential monetary gain of one malicious interaction that leverages the PoC reputation over the existing PoC balance.

An inconvenient barrier facing potentially malicious actors is trying to make this comparative analysis accurate since they will be trying to measure the perceived value that comes from genuinely boosting a reputation score to exhaust it all in a single heist.

How Do We Parallel Existing Business Models?

Although this concept is far from perfect, it’s infinitely better than existing accountability models for businesses, such as Yelp, Google Maps, and other platforms that allow user reviews.

Figure 4: An article published on D Magazine claims many google reviews are fake and paid for

Many of these products have each spawned micro-economies that exchange money for manipulation – pumping numbers with inauthentic reviews. The revenues created by some of these businesses show genuine interest in fast-tracking a business and thinking creatively about gaining customers, so we can’t dismiss this idea entirely.

A collateralized reputation system might provide an easy fix that aligns with the company’s financial goals. It’s important to drive as much value to a fungible token as possible from other products or features if the token is being used as a reward mechanism.

This is the basis of sustainability in a token economy and can be done through buybacks with deflationary mechanisms or lockups. The latter can help stabilize token prices, reduce volatility, and allow the team an avenue to execute responsible treasury liquidations.

Creating a Circular Token Economy

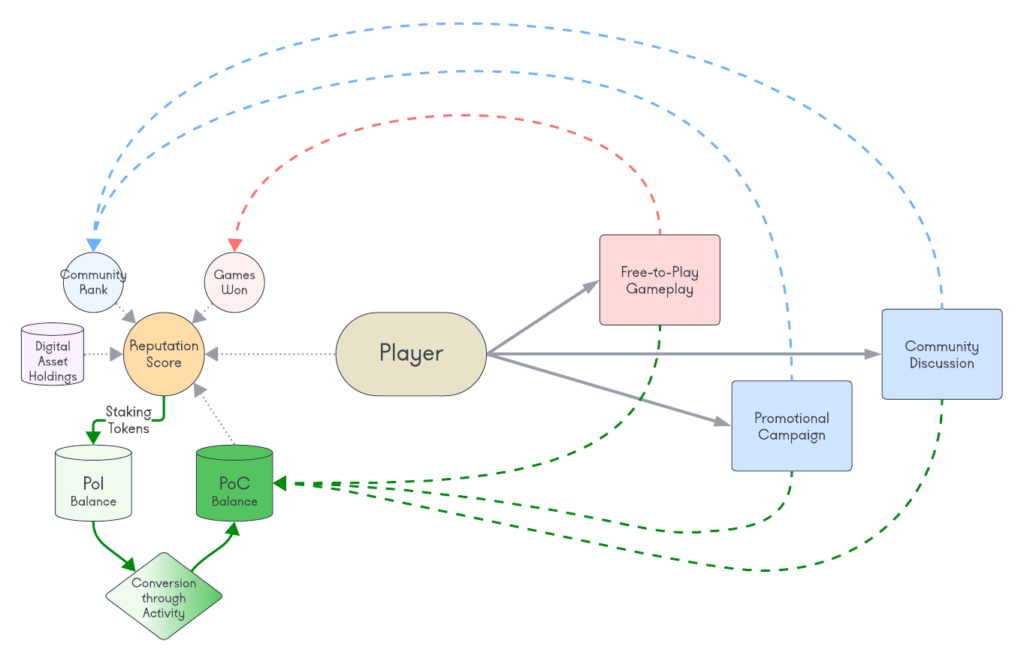

Incorporating a token lockup into the concept of boosting reputation may be a win-win for everyone. This can be done by allowing users to purchase tokens and stake them into a separate custodial contract, which will boost their profile’s reputation at some fractional multiplier. Instead of measuring Proof-of-Contribution, we’re now measuring something different – “Proof-of-Investment” (PoI).

Figure 4: PoI staking balance is converted into PoC balance through positive player contribution

Many may dismiss staking utilities but granting something of value for a financial show of faith is simply good business. Additionally, accountability can be introduced by holding this PoI balance as collateral in the event a user performs some malicious action, resulting in striking this balance.

To ensure locking value in the ecosystem, the company may consider this stake a one-way deposit which allows users to slowly convert this PoI balance into a PoC balance through demonstrating healthy behavior and positive interactions in the economy. The incentive in this conversion may be the difference in multipliers between the PoI and the eventual PoC balances that are used to calculate their final reputation score.

Suddenly, we’ve created a robust accountability system and a new, native token revenue stream, all while addressing real-world, existing problems.

Arcanum Ventures Tokenomics

Arcanum Ventures has used these concepts in several token economies that span gaming, telecommunications, software service companies, and decentralized protocols. Our goal is to leverage blockchain technology to incorporate greater transparency and accountability in future businesses.

If this content interests you, be sure to reach out to Arcanum Ventures to help design your company’s token economy.

Arcanum Ventures

Arcanum Ventures is a venture capital investment firm, blockchain advisory service, and digital asset educator. We bring precise knowledge and top-tier expertise in advising blockchain startups.

Arcanum demystifies the blockchain space for its partners by providing intelligent, poised, crystal clear, and authentic input powered by our passion to empower and champion our allies.

We unravel the mysteries and unlock the opportunities in blockchain, Web3, and other emerging innovations.

February 11, 2025

Governance has a bad reputation in web3. The presumed miracle drug for any weak token economy has been thrown…

InvestmentPartnershipsToken Economics

January 28, 2025

Spheron is developing and launching infrastructure to simplify the world of GPU and CPU resource provisioning…

October 8, 2024

It goes without saying that starting a new business in any industry is an exciting venture, but so too does…