Arcanum Ventures

Arcanum Ventures is a venture capital investment firm, blockchain advisory service, and digital asset educator. We bring precise knowledge and top-tier expertise in advising blockchain startups.

Arcanum demystifies the blockchain space for its partners by providing intelligent, poised, crystal clear, and authentic input powered by our passion to empower and champion our allies.

We unravel the mysteries and unlock the opportunities in blockchain, Web3, and other emerging innovations.

Node Sales Explained: Infrastructure Meets Fundraising

Arcanum Ventures sees blockchain and cryptocurrency as a form of infrastructure rather than products themselves. A similar example can be seen in fiber-optic internet. This infrastructure offered easier and faster connectivity than its predecessor, Digital Subscriber Lines (DSL).

As infrastructure, blockchain and cryptocurrency can benefit many aspects of a business or organization. In these cases, businesses may justify the creation of their own blockchain networks, or “application chains,” that take advantage of the immutable data records of decentralized ledger technology.

The Rise of Application Chains

Application chains are unique networks that typically serve a single purpose, such as the storage and querying of a patient’s medical data, or providing a framework for a gaming studio to launch various titles that allow seamless interconnectIvity of digital assets between them. Many application chains are built on top of popular blockchain networks, taking advantage of:

- The parent network’s security and decentralization [Ethereum]

- Low costs of transaction settlement [Arbitrum]

- Built-in data privacy protocols [zkSync]

- Modular infrastructure for fast and easy building [Cosmos]

Each parent network may offer inherent benefits to application chains built on top, such as customizable metrics and unique security integrations. This means application chains can be customized specifically for web3 gaming (fast and cheap transactions) or IoT security (safe and reliable). Depending on the need for redundancy and decentralization, these application chains can use a distributed network of nodes.

What are Nodes?

Nodes are key components of blockchain networks, acting as custodians that help maintain the blockchain by storing transaction data and writing new transactions. To give an example of how they work, think of nodes as librarians in a library. These people organize books, allow and track the transfer of books, record books being dropped off again at the library, and keep a record of where all library books are among the individuals who hold them. Just like librarians, nodes do many things for their respective blockchains. Some blockchains use different types of nodes, that may have different responsibilities or capabilities:

- Full Nodes: They store the entire blockchain’s data, validate transactions and blocks, and maintain network security – they have all of the responsibilities. Ethereum nodes are a perfect example.

- Validator / Verifier Nodes: A critical part of Proof-of-Stake (PoS) networks in validating transactions and blocks, and often require some staked cryptocurrency to operate.

- Masternodes: Similar to full nodes but with additional functionality like enabling instant transactions or participating in governance.

- Archive Nodes: Archive nodes store the entire blockchain history, providing data access for historical queries.

- Light Nodes: Light nodes store block headers versus actual blockchain data, instead of relying on full nodes to verify transactions.

- Relay Nodes: Relay nodes help with communication between nodes, typically regarding information from blocks and transactions.

- Edge Nodes: Edge nodes are typically used in IoT systems where they position data closer to the users of the protocol or product, reducing latency.

- Fake Nodes: NFTs sold as “nodes,” however have no responsibilities or functionalities in regards to network operation or security.

The Role of Nodes in Application Chains

Certain application chains allow the deployment of different types of nodes, even multiple types on the same network. However, recent sales have focused on limited access nodes such as Verifier, Relay, and Light Nodes. These nodes may perform different functions for the application chain such as:

- Transaction Validation: They verify transactions and ensure that the sender has sufficient funds to prevent double-spending

- Consensus Mechanism: They are part of the consensus process (e.g., Proof-of-Work, Proof-of-Stake) to agree on the validity of transactions and blocks

- Network Security: They maintain the blockchain by keeping a copy of the ledger and checking for fraudulent transactions

- Data Storage and Retrieval: They store transaction data and provide access to the entire database on the blockchain

Functions aside, nodes can also have different benefits, drawbacks, and levels of customization, depending on the parent network the infrastructure is built on. Some examples of differences between nodes are listed below for Arbitrum Orbit Chain and zkSync Hyperchain, two popular networks for application chains:

Table 1: Comparison between Arbitrium Orbit Chain Nodes and zkSync Hyperchain Nodes

What Are Node Sales?

While owning and operating a node can be a responsibility, it can also be a privilege. Nodes receive an incentive of “network rewards” for performing their duties, fueled by “gas fees” collected from the network. Some blockchains even use programmatically distributed rewards that grant more tokens to each node as an added incentive. Several projects have used these added rewards to offer their “node sale” as a fundraising campaign. Investors not only gain a share of network fees, but they also get a token allocation!

In this sense, these projects have been treating node sales as a token pre-sale campaign, where the project’s team can raise funds through the sale of nodes while distributing tokens to the network’s greatest contributors.

In theory, this sounds like a perfect system. Stakeholders who are actively contributing to the blockchain are gaining a greater share of the value that is being produced. In protocols that use token-powered governance, this means these contributors are gaining the greatest voice in the network.

In practice, there’s been a big problem…

Key Node Sale Concepts

Many investors don’t seem to understand the math behind node sales. As a result, many early node sales were able to raise tens of millions of dollars in exchange for nearly nothing. When analyzing a node sale, it’s important to understand several key concepts:

1. Supply

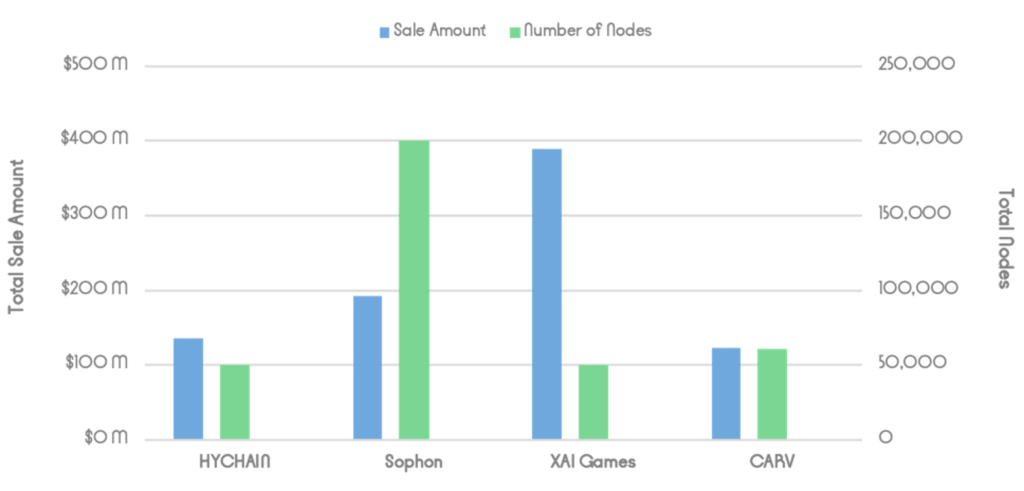

Some sales offer a supply of 10,000 nodes while others exceed 200,000. It’s important to understand the total supply dynamics since a greater supply can help the blockchain achieve greater decentralization, redundancy, and security. On the other hand, a large supply of nodes at a high price begs the question, “What will the funds be used for, and does it make sense in the context of what they’re building?”

Fixed vs Inflationary supply is also critical. If the project can sell more nodes at a later date, then it will dilute the number of tokens going to each investor.

Figure 1: Supply and total fundraise amounts for popular node sales

2. Token Rewards

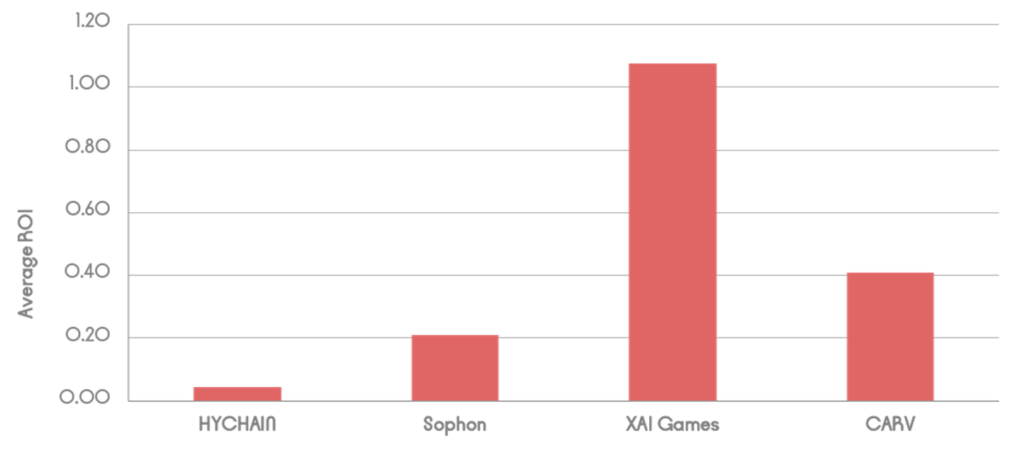

Each node sale may offer different reward structures. Nodes will be eligible to receive a portion of network fees. This means each transaction fee collected will be split between the node operator and the foundation. This split can be anywhere from 0 – 100% but typically ranges between 25%-50%.

Additional token rewards are granted to each node from a portion of the supply. These supply portions can be labelled “Network Rewards” or “Node Operators,” and can range anywhere from 5% to 75% of the total token supply. This percentage is not important. What is, is the number of tokens going to each node? This can be calculated by dividing the total token supply for “Node Operators” by the total supply of nodes.

For example, let’s say half of the token supply is going to node operators, and that is equal to 500 million tokens. The company is selling 50,000 nodes in total. This means each node should receive a minimum of 10,000 tokens.

Depending on the network, each node could receive way more than this minimum. It’s common for application chains to distribute token rewards linearly over a specific period, like 30 months. This means each epoch (time period for which a network validates transactions) releases a specific number of tokens to nodes. These token rewards are granted only to nodes that are active during that epoch, meaning an active node may get way more than the minimum amount of tokens should other nodes lie consistently dormant. For context, many application chains see between 20-40% dormant nodes.

Figure 2: ROI for average node sold across most popular node sales

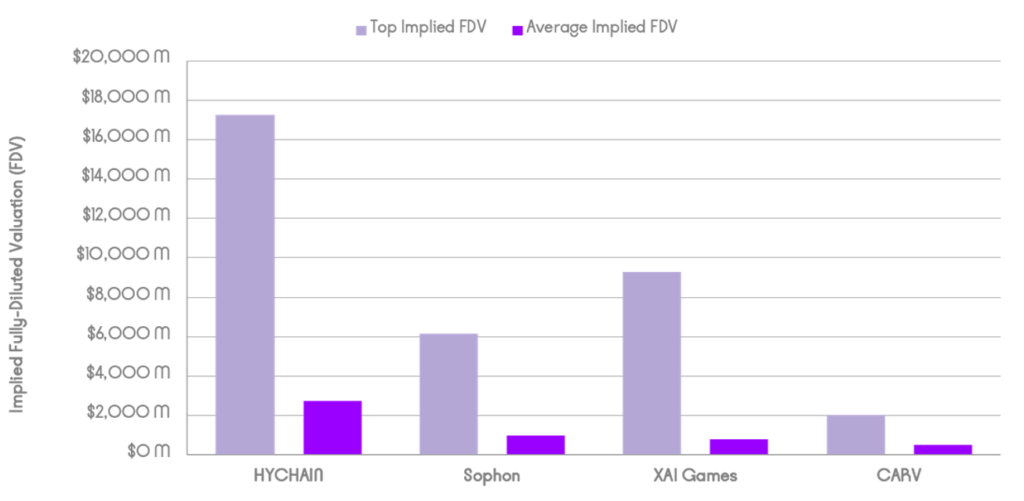

3. Implied Fully-Diluted Valuation (FDV)

Many node sales offer different tiers, each with varying supplies and prices. So how do you figure out if you’re getting a good deal?

It is important to calculate what the node IS WORTH. If we know the public listing price of the token will be $1.00, then a node that grants 10,000 tokens minimum can technically be worth $10,000, if the token price stays the same after listing. If you paid $20,000 for the node, then the token price must maintain $2.00, or 2x, consistently through the entire token distribution period for you to break even on your investment.

Some notable offerings, like Sophon or XAI Game, sold nodes at such high prices that investors have nearly a 0% chance of making a gain. For investors in either of these offerings to break even, token supplies must maintain valuations exceeding $8,000,000,000. This means they need to hold a spot in the top 15 cryptocurrencies for the next 3-4 years.

Figure 3: Average and top implied FDVs needed to breakeven for the most common node sales

If you’re trying to calculate the number of tokens you’ll receive just from network activity, don’t bother. Most application chains are built on existing L1s and L2s that are fast, cheap, and efficient. Additionally, companies building their own application chains have very little reason to use high transaction fees, regardless of which industry they are in. For example, in order for the average HYCHAIN node investor to break even for network activity, HYCHAIN must hit 48% of Solana’s activity over the next 2 years. That’s nearly 20,000,000 transactions a day.

For XAI Games node investors, the network must exceed Solana’s network activity, maintaining over 54,000,000 transactions daily for the next 2 years. Likely to happen? We don’t think so.

4. Rewards Eligibility

Each chain may have different node operation requirements. Some may need a node to be constantly active, 24 hours a day, to be eligible for receiving its prescribed token rewards. Others may require the node to be active only once a day to execute some simple validation.

While there is some technical understanding needed to run a node, many investors don’t have the technical knowledge or specific hardware to do so. In many cases, investors must shell out extra money for someone else to do it. Some of these “Node Operations” agencies can charge up to $20 per month. This unforeseen cost can seriously eat away at investors’ profits.

On the other hand, some nodes don’t need to be operated at all and are always eligible to receive their token rewards regardless of their uptime. In these cases, investors haven’t actually purchased nodes – they’ve purchased NFTs that grant them some token distribution – no different than the 2021 metaverse land sales.

Node Sales Have Potential for Fundraising

The most notable node sales like Sophon, Aethir, and XAI are deemed successful because of the sheer amount of money they raised. Sophon’s node sale raked in over $60 million dollars while XAI’s node sale brought in over $40 million. Some of the largest and most successful blockchain networks in the world have done more with less capital. So we need to ask, are these projects structuring node sales ethically?

Are they raising the appropriate amount of money or are they offering something of low value to investors that are consistently overpaying?

Arcanum Ventures believes purpose-driven blockchains have a permanent place in our technological future. These application chains can offer custom networks that are catered directly to a private bank, a gaming studio’s inter-connected titles, or a DePIN’s data infrastructure.

We believe nodes have a permanent place in this industry, and they’ll continue to grow in importance. The way they may be offered, sold, or distributed may change, however. The industry’s sentiment around node sales has been ruined, as the earlier and more prominent node sales have corrupted the practice and muddied the waters.

The Future of Node Sales

We will continue to see node sale offerings come to market but at much better values, lower implied FDVs, and greater node operator rights.

While teams continue to use node sale campaigns instead of token pre-sale campaigns, they’ll need to make the finances make sense. For example, reducing the implied FDV for node investors below their public listing price. A small first step in the right direction.

Reach out to Arcanum Ventures if this content interests you or if you need help structuring a node sale for your blockchain network.

Arcanum Ventures

Arcanum Ventures is a venture capital investment firm, blockchain advisory service, and digital asset educator. We bring precise knowledge and top-tier expertise in advising blockchain startups.

Arcanum demystifies the blockchain space for its partners by providing intelligent, poised, crystal clear, and authentic input powered by our passion to empower and champion our allies.

We unravel the mysteries and unlock the opportunities in blockchain, Web3, and other emerging innovations.

February 11, 2025

Governance has a bad reputation in web3. The presumed miracle drug for any weak token economy has been thrown…

InvestmentPartnershipsToken Economics

January 28, 2025

Spheron is developing and launching infrastructure to simplify the world of GPU and CPU resource provisioning…

October 8, 2024

It goes without saying that starting a new business in any industry is an exciting venture, but so too does…