Arcanum Ventures

Arcanum Ventures is a venture capital investment firm, blockchain advisory service, and digital asset educator. We bring precise knowledge and top-tier expertise in advising blockchain startups.

Arcanum demystifies the blockchain space for its partners by providing intelligent, poised, crystal clear, and authentic input powered by our passion to empower and champion our allies.

We unravel the mysteries and unlock the opportunities in blockchain, Web3, and other emerging innovations.

The Evolution of Cryptocurrency Vesting

Cryptocurrency investment strategies are unique to every venture capitalist and entrepreneur. Each individual or organization develops their own research process and, along with it, the evaluation process.

Arcanum Ventures Cryptocurrency Fundamentals

Fundamental analysis is the cornerstone of our investment arm at Arcanum Ventures. We pride ourselves on deeply understanding the industry through our experience incubating and launching projects.

Additionally, our assessments are informed by having built a company from the ground up and having experienced all of the various hurdles a startup team may encounter.

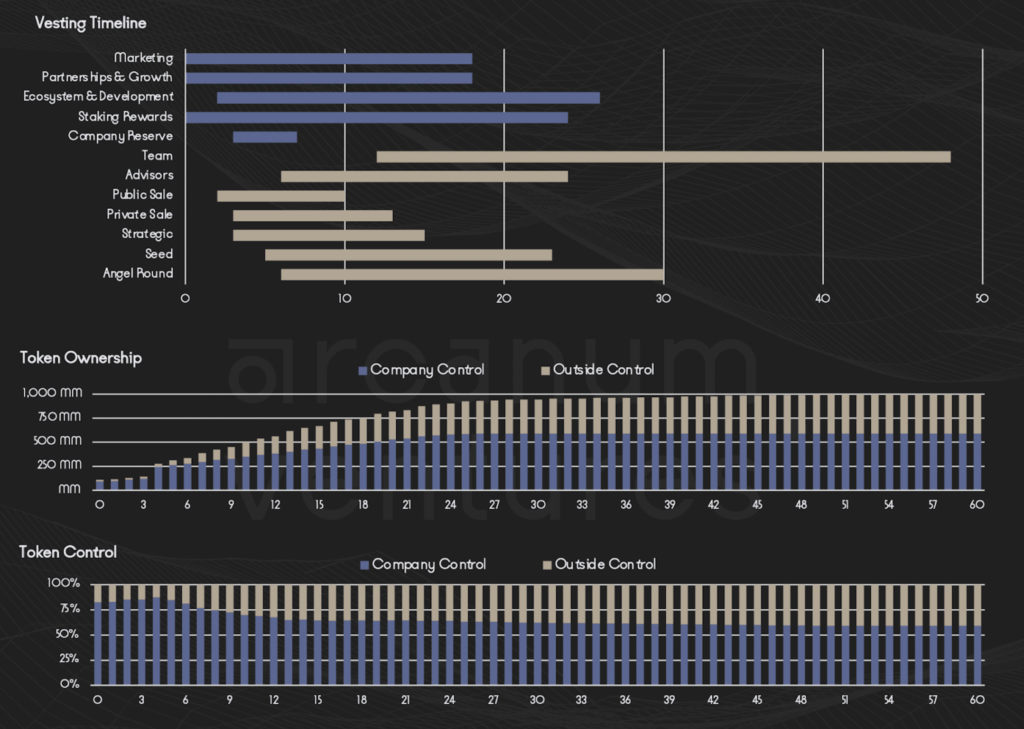

Figure 1: Arcanum Ventures Fundamental Analysis report for YieldBricks evaluates Vesting Emissions

As a result, we’re tough on investment opportunities, gauging the viability of business development strategies and financial management with criticality. Although our approach is distinctive, there are some commonalities we share with investors across all of the industry. These commonalities are typically return-focused metrics that are rooted in financial management. Vesting is one of those primary metrics.

Venture Capitalists Love Token Vesting

Cryptocurrency investments offer venture capitalists something they never had before – early liquidity.

These digital assets granted opportunities to secure returns against financial risk at a far earlier stage. The viability of these opportunities was largely measured by equity transfer terms – “vesting schedules,” in the case of web3.

“Vesting” specifically refers to the schedule dictating when your purchased investment will be earned or transitioned into your ownership. These distribution terms vary widely between industry niche, fundamental strength of the team, and even market conditions, but one thing is certain. Regardless of the terms, token vesting shortened returns horizons for traditional tech startup investors. Additionally, the accessibility of “crypto deal-flow” to any individuals with a pocketbook significantly widens the gateway.

Figure 2: YouTube Crypto Influencers Manipulating Algorithm and Promising Unrealistic Returns

Unfortunately, the modern cryptocurrency landscape is littered with novice investors. Many of these were ushered in with promises of 100x returns from YouTube, pump-and-dump influencers. These investors were emboldened with early gains in risk-heavy ventures that granted them validation. As a result, the fundamental analysis, or “due diligence,” process of this demographic remained surface-level at best.

Vesting as a Prescribed Dump Schedule

Many investors still jump to vesting schedules first as an evaluation method – to understand when they can receive their reward for capital input. This transitioned the “vesting schedule” into a prescribed “dump schedule” as this investor demographic was far more concerned with early exits over the long-term viability of the technology and the value brought by the product.

Figure 3: Token Price chart of highly anticipated token launch after heavy liquidations

Project founders were dumbfounded as backers who promised long-term support liquidated their early-stage investments transparently on the blockchain. Models prescribing four to six-month releases on seed rounds crumbled as these stakeholders dumped.

Any upward movement in token price cratered below launch prices and project valuations fell to nearly nothing. Web3 cap tables devolved into betting grounds for a race to the bottom of the liquidity pool.

The Shift in Vesting Schedules

The token economics landscape slowly shifted as project founders became warier of fast-talking, early-stage investors who promised the world yet delivered nothing besides sell pressure. Vesting schedules followed as they lengthened on average from eight to twenty-four months since April of 2021. Founders have come to understand, “what can happen, will happen,” as venture capitalists feeling the pressure of a declining hype market liquidated all holdings as soon as they were received.

Thus, token sale models continued shifting towards structures commonly seen in the traditional technology startup space. Vesting schedules were extended, valuations were lowered, and more collaborative conversations were had about liquidation strategy.

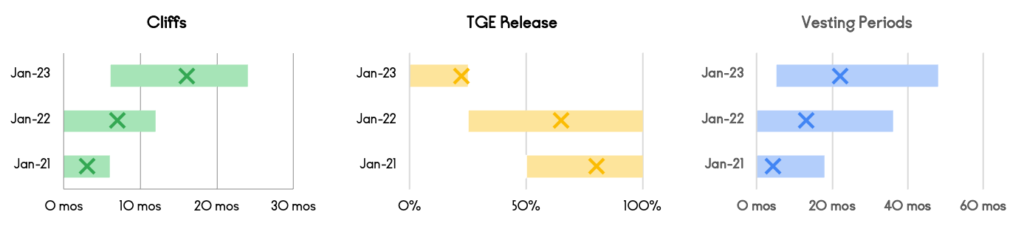

Figure 4: Shift in vesting metrics ranges and weighted averages from April 2021 to April 2023

This shift will continue as web3 investors become more educated. It’ll accelerate with a better understanding of the risks around speculative token launches – particularly ones that deliver very little information on product delivery and focus primarily on KOL Marketing Methods. These investors will begin to lengthen their horizons and their fundamental analysis processes will include questions like “What do you envision five years from now?”

How Does The Web3 Investment Space Move Forward?

Arcanum Ventures continues to be critical of early-stage investments in this landscape. Our evaluation process predicates a strong alignment between our core ethos and the values shared by a founding team.

We look for teams that are dedicated to developing products that will take this industry forward and progress the technology. Additionally, we prioritize teams that demonstrate fiscal responsibility by creating more equitable and fairer token sale models. We place a lot of value on understanding budgetary needs and aligning fundraising efforts and token sale structures accordingly.

If you find commonality in this vision and need support with your token economy, please reach out to Arcanum Ventures about collaborating.

Arcanum Ventures

Arcanum Ventures is a venture capital investment firm, blockchain advisory service, and digital asset educator. We bring precise knowledge and top-tier expertise in advising blockchain startups.

Arcanum demystifies the blockchain space for its partners by providing intelligent, poised, crystal clear, and authentic input powered by our passion to empower and champion our allies.

We unravel the mysteries and unlock the opportunities in blockchain, Web3, and other emerging innovations.

February 11, 2025

Governance has a bad reputation in web3. The presumed miracle drug for any weak token economy has been thrown…

InvestmentPartnershipsToken Economics

January 28, 2025

Spheron is developing and launching infrastructure to simplify the world of GPU and CPU resource provisioning…

October 8, 2024

It goes without saying that starting a new business in any industry is an exciting venture, but so too does…